The IRS today continued its ongoing effort to help those experiencing homelessness during the pandemic.

MONEY MANAGEMENT

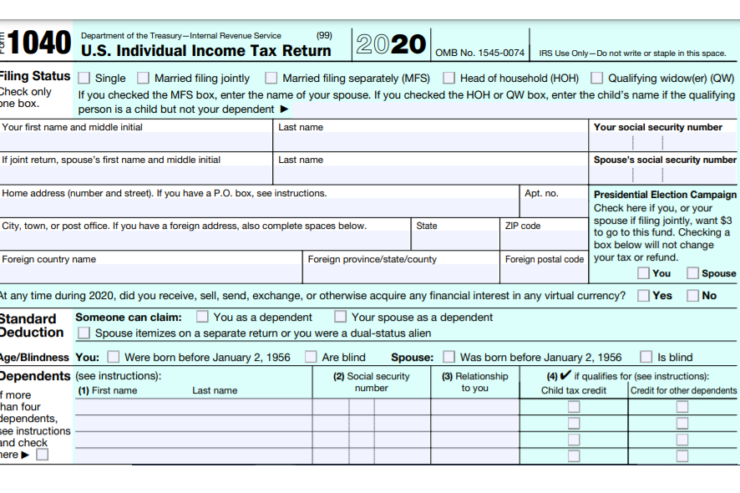

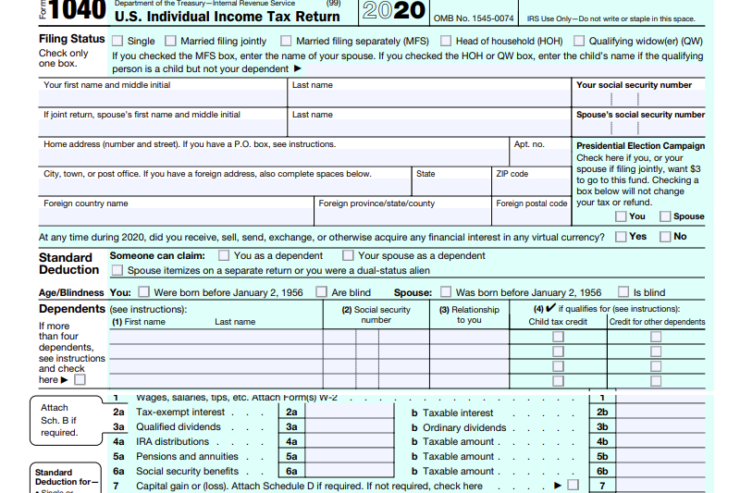

IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May

A recent law change allows some recipients not to pay tax on some 2020 unemployment compensation.

University students and staff should be aware of IRS impersonation email scam

People should be aware of an ongoing IRS impersonation scam that appears to target educational institutions, students, and staff.

COVID-19 Fraud Alert

Be aware that criminals are attempting to exploit COVID-19 worldwide through a variety of scams.

Millions Of American Parents Will Soon Get A Monthly Allowance: 4 Questions Answered

The $1.9 trillion relief package Congress passed on March 10 will temporarily expand the child tax credit.

A Texas Lender Sued Thousands Of Low-Income Latinos During The Pandemic. Now The Feds Are Investigating.

A Texas lender sued thousands of low-income Latinos during the pandemic. Now the feds are investigating.

Tax Time Guide: Didn’t Get Economic Impact Payments? Check Eligibility For Recovery Rebate Credit

The IRS reminds first-time filers and those who usually don’t have a federal filing requirement to consider filing a 2020 tax return.

Child Poverty In The U.S. Could Be Slashed By Monthly Payments To Parents – An Idea Proved In Other Rich Countries And Proposed By A Prominent Republican Decades Ago

Congress and the nation are again debating a major boost in government support for families with children.

What Taxpayers Need To Know To Claim The Earned Income Tax Credit

The EITC can give qualifying workers with low-to-moderate income a substantial financial boost.

Business Debt: Hidden Advantage For Giant Firms Means Economy Has Been K-Shaped For Decades

Research reveals how talk of a K-shaped recovery misses the point.