Tips on situations in which a taxpayer may need to file an amended return to make a correction.

MONEY MANAGEMENT

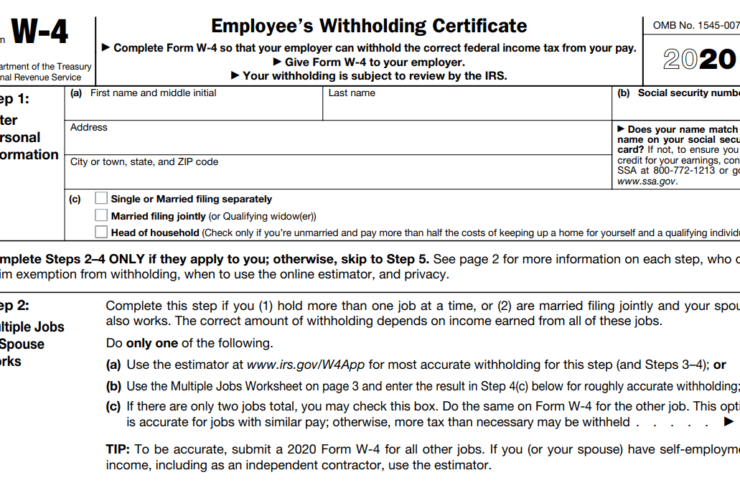

Tips For Taxpayers Who Need To File A New W-4

The IRS urges all taxpayers to review their withholding annually.

IRS: Unemployment Compensation Is Taxable; Have Tax Withheld Now And Avoid A Tax-Time Surprise

By law, unemployment compensation is taxable and must be reported on a 2020 federal income tax return.

Special Tax Benefits For Members Of The Military And Their Families

Members of the military and their families are often eligible for certain tax breaks.

Attention Teachers: Those School Expenses Might Be Tax Deductible

Eligible educators can still deduct certain unreimbursed expenses on their tax returns next year.

Rent Is Unaffordable In Every Single State In America

According to a new report, safe and affordable housing is increasingly out of reach for low-income renters.

Don’t Forget, Social Security Benefits May Be Taxable

Taxpayers receiving Social Security benefits may have to pay federal income tax.

Stop Seizing Paychecks, Senators Write To Capital One And Other Debt Collectors

Wage garnishments ordered before the pandemic started have continued for many workers during the recession.

Gig Economy Tips Taxpayers Should Remember

The gig economy is activity where taxpayers earn income providing on-demand work, services, or goods.

We Call Workers ‘Essential’ – But Is That Just Referring To The Work, Not The People?

Is “essential” describing the workers themselves? Or only the work they do?