What is credit scoring?

Credit scoring is a method creditors use to help determine whether to give you credit. It also may be used to help decide the terms you are offered or the rate you will pay for the loan.

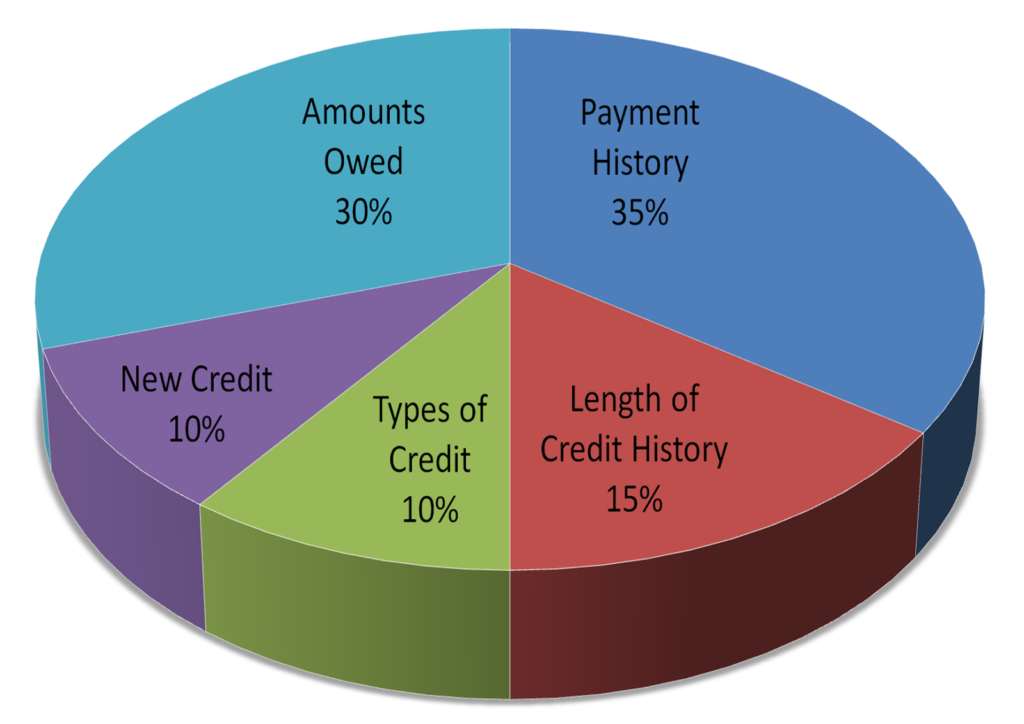

Information about you and your credit experiences, like your history of paying bills, the number and type of accounts you have, whether you pay your bills by the date they’re due, collection actions, outstanding debt, and the age of your accounts, is collected from your credit report. Using a statistical program, creditors compare this information to the loan repayment history of consumers with similar profiles. For example, a credit scoring system awards points for each factor that helps predict who is most likely to repay a debt. A total number of points — a credit score — helps predict how creditworthy you are: how likely it is that you will repay a loan and make the payments when they’re due.

Some insurance companies also use credit report information, along with other factors, to help predict your likelihood of filing an insurance claim and the amount of the claim. They may consider this information when they decide whether to grant you insurance and the amount of the premium they charge. The credit scores insurance companies use sometimes are called “insurance scores” or “credit-based insurance scores.”

One of the most important financial numbers you need to keep an eye on is your credit score. While there may be many different types of credit scores out there, the most important credit score is the FICO credit score. It is used by most U.S. lenders to determine whether or not to approve you for credit cards, car loans, mortgages, and other lines of credit.

Credit scores and credit reports

Your credit report is an important part of many credit scoring systems. That’s why it is critical to make sure your credit report is accurate. Federal law gives you the right to get a free copy of your credit reports from each of the three: Experian, TransUnion and Equifax national credit reporting companies once every 12 months.

Your credit report is an important part of many credit scoring systems. That’s why it is critical to make sure your credit report is accurate. Federal law gives you the right to get a free copy of your credit reports from each of the three: Experian, TransUnion and Equifax national credit reporting companies once every 12 months.

The Fair Credit Reporting Act (FCRA) also gives you the right to get your credit score from the national credit reporting companies. They are allowed to charge a reasonable fee for the score. When you buy your score, you often get information on how you can improve it.

To order your free annual credit report from one or all of the national credit reporting companies, and to purchase your credit score, visit www.annualcreditreport.com, call toll-free 877-322-8228, or complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P. O. Box 105281

Atlanta, GA 30348-5281