What is a budget?

What is a budget?

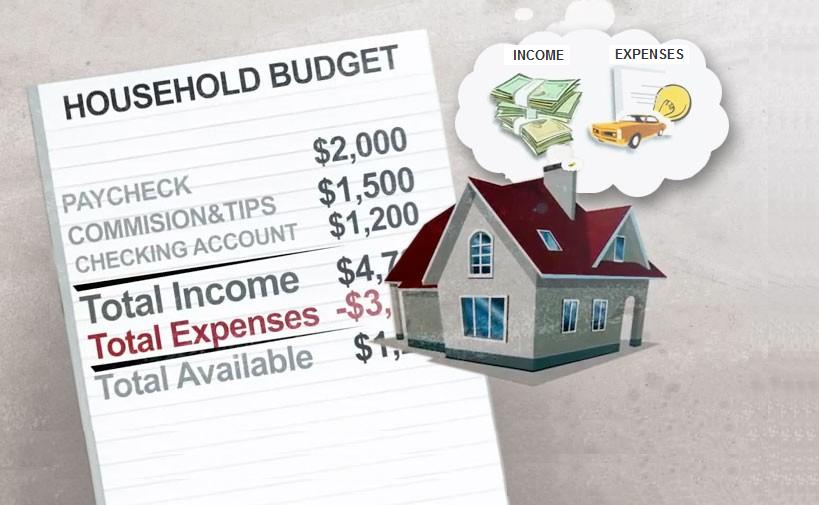

A budget is a plan you write down to decide how you will spend your money each month.

A budget helps you make sure you will have enough money every month. Without a budget, you could run out of money before your next paycheck.

A budget will show you:

- How much money you make

- How you spend your money

Why do I want a budget?

Creating a budget can help you get control of your finances. Having control over your money is important for your financial well-being and peace of mind. When you create a budget, you put all of your income and expenses in one place to examine, allowing you the ability to create a financial plan.

A budget helps you decide:

- What you must spend your money on

- If you can spend less money on some things and more money on other things

Things to remember about a budget are:

- A good budget means you are never spending more than you are earning.

- If you can, your budget should include savings for your big goals, like buying house, car or planning a vacation.

- If possible, try to leave some room in your budget for the surprises in life or what some call a rainy day fund— like repairing your car or an appliance.

Updating your budget each day, week or month as you spend money lets you see if your budgeted expenses were realistic and whether or not you will meet your annual goals for debt reduction and savings.

Types of Expenses

Fixed Expenses

Fixed expenses are expenses you cannot really control because they’re necessary. Fixed expenses — like rent or car payments occur regularly and don’t change from month to month. Fixed expenses:

- Occur regularly

- Are necessary for day-to-day living

- Don’t change from month to month

Flexible Expenses

Flexible expenses occur regularly, and they are expenses that you cannot really get around. Flexible expenses:

- Occur regularly

- Are necessary for day-to-day living

- You have some control over the amount

Discretionary Expenses

The difference is that with flexible expenses, you have some control over how much you spend. Adults, for example, have to spend money on electricity or groceries, but can make choices over how much they spend.

Discretionary expenses is money you choose to spend — like money for movies or having dinner with friends — or even money that you save. Discretionary expenses:

- You choose to have the expense

- You control the amount

Remember, your budget is a general plan. If your expenses change, or if you have an emergency expense, your budget will have to change too. So try to keep yourself a few dollars left over every month for pocket change — or to help pay for the unexpected.

A budget does a good job balancing the family’s needs and wants. It covers the family’s fixed and flexible expenses — and even has room for discretionary and emergency funds.