By Noah Kirsch, Forbes | Jan 14, 2019

By Noah Kirsch, Forbes | Jan 14, 2019

Wealth concentration in the United States—which is intensifying across the board—has impacted minority groups the hardest.

That is the thesis of a new report from the Institute for Policy Studies, a left-leaning think tank based in Washington, D.C.

Utilizing data from the Federal Reserve, Bureau of Labor Statistics and Forbes rich lists, among other sources, the institute found that the 400 richest Americans hold more wealth than “all Black households, plus a quarter of Latino households [combined].”

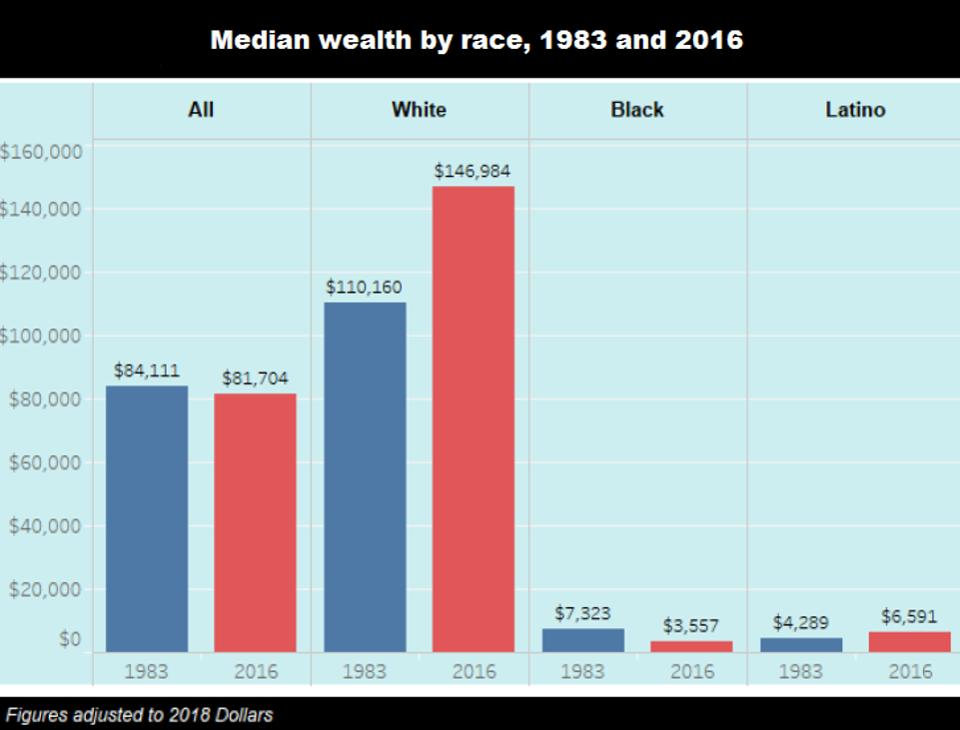

Separately, the study noted, “Between 1983 and 2016, the median Black family saw their wealth drop by more than half after adjusting for inflation, compared to a 33% increase for the median White household.” At present, the median Black family has assets of $3,600, roughly 1/4oth that of the median White household, the institute reports.

Among the study’s other striking conclusions:

Among the study’s other striking conclusions:

- Black families are about 20 times more likely to have zero or negative assets (indebted) than they are to be worth $1 million or more. Latino households are 14 times more likely to have zero or negative assets than they are to be millionaires. Meanwhile, white households are equally likely to fall into either category.

- The wealth of the median Latino family rose 54% between 1983 and 2016, to $6,600. Still, the wealth of typical Latino household is 1/22nd that of the median white household.

“Wealth is where the past shows up in the present. From slavery to Jim Crow, to redlining, to mass incarceration, the division of assets on the basis of race has been explicit public policy for centuries,” says Josh Hoxie, one of the study’s co-authors.

International disparities resemble those in the United States. Of the 2,043 individuals who made Forbes’ 2018 list of the World’s Billionaires, just 11 were black. Additionally, a 2018 Oxfam analysis found that the world’s 42 richest people hold as much wealth as the poorest 3.7 billion people combined.

The Institute for Policy Studies’ latest report emphasizes that wealth concentration in the U.S. is increasing across demographics. For instance, the three richest Americans—Jeff Bezos, Bill Gates and Warren Buffett—hold more wealth than the bottom 50% of the country combined, the institute says. That statistic mirrors the barrier to entry for The Forbes 400. In 1982, the list’s inaugural year, the minimum net worth was $100 million. This year the cutoff hit an all-time high of $2.1 billion.

Inversely, a 2017 Federal Reserve report found that 40% of adults would not have the cash to cover an unexpected expense of $400. The same report found than one in five adults cannot pay all of their monthly bills, while more than a quarter skip necessary medical care because they can’t afford it.

Some billionaires, including Bill Gates, have acknowledged the significance of wealth and income inequality. “High levels of inequality are a problem—messing up economic incentives, tilting democracies in favor of powerful interests, and undercutting the ideal that all people are created equal,” Gates wrote in a 2014 blog post. His wife, Melinda, echoed the sentiment in their foundation’s 2018 annual letter: “It’s not fair that we have so much wealth when billions of others have so little. And it’s not fair that our wealth opens doors that are closed to most people.”

For his part, Warren Buffett cites “an advanced market-based economy” for the gap between the rich and the poor. Still, he wrote in a 2015 op-ed, “The poor are most definitely not poor because the rich are rich. Nor are the rich undeserving.”

Reversing current trends is proving difficult. Proposals range from establishing bonds for young children, to guaranteeing a basic income, to raising the estate tax, to expanding access to affordable medical care and housing—any of which is guaranteed to be politically explosive. Identifying a problem is often easier than fixing it.

Follow Noah on Twitter @Noah_Kirsch.