IRS warns taxpayers to avoid unethical tax return preparers, known as ghost preparers.

IRS

What Taxpayers Should Consider When Determining If They Need To File

As people prepare to file their taxes, there are things to consider.

Combat-Injured Disabled Veterans May Be Due A Refund

The IRS is alerting certain veterans that they may be due a credit or refund.

Treasury, IRS Issue Proposed Regulations On New 100 Percent Depreciation Deduction

Proposed regulations on the new 100-percent depreciation deduction.

What Taxpayers Should Know About Penalty Relief

Taxpayers who make an effort to comply with the law may qualify for relief from penalties.

Missed The Tax Deadline And Owe Tax? To Avoid Higher Late-Filing Penalty File By June 14

IRS urges affected taxpayers to avoid the penalty increase by filing their return by June 14, 2018.

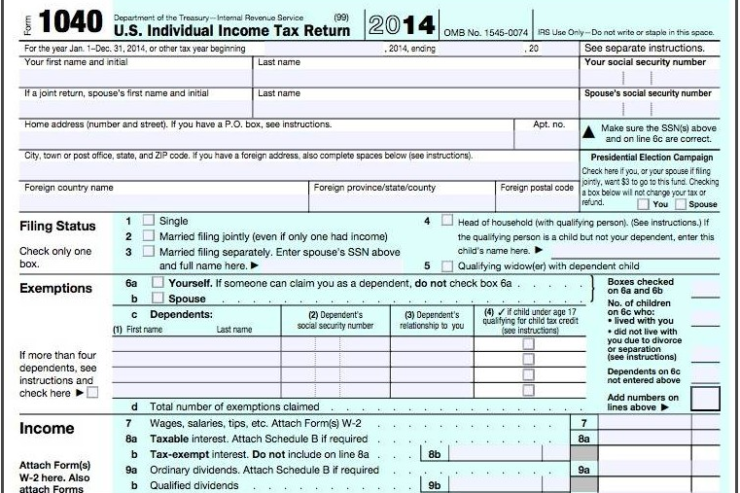

Time is Running Out to File 2014 Tax Returns Worth $1 Billion in Refunds

Time’s running out to file 2014 federal tax return and claim a refund.

IRS: Refunds Worth $1.1 billion Waiting to be Claimed

Over $1.1 billion waiting to be claimed by those who have not filed 2014 federal income tax returns.

Over $1.1 billion waiting to be claimed by those who have not filed 2014 federal income tax returns.

Over $1.1 billion waiting to be claimed by those who have not filed 2014 federal income tax returns.

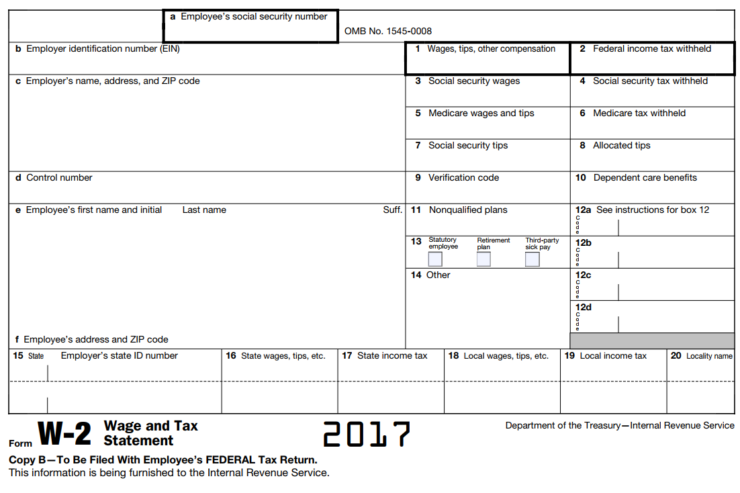

No Form W-2, Wage and Tax Statement? Get Help From IRS

Haven’t received your Form W-2, Wage and Tax Statement, yet? The IRS can help.

Free Tax Software Available Now through Free File

Taxpayers can start preparing and e-filing their taxes free with IRS Free File software on January 12.