FICO, which stands for the Fair Isaac Corporation, is the leader in measuring consumer credit risk. Why you need to understand what a FICO score is, and how it’s used.

FICO, which stands for the Fair Isaac Corporation, is the leader in measuring consumer credit risk. Why you need to understand what a FICO score is, and how it’s used.

One of the most important financial numbers you need to watch is your credit score. While there may be many different types of credit scores out there, the most important credit score is the FICO credit score. It is used by most United States lenders to determine whether or not to approve you for credit cards, car loans, mortgages, and other lines of credit.

The FICO score is a number that predicts how likely you are to pay back a loan or other credit obligations in a timely fashion. FICO scores are calculated from the data in your credit reports housed at the three main credit bureaus, Experian, TransUnion and Equifax. The scores consider information about your payment history, use of available credit, plus other factors. Most of us have FICO scores for each of our credit reports, however, if you don’t have any recently reported credit history, you won’t have a FICO score.

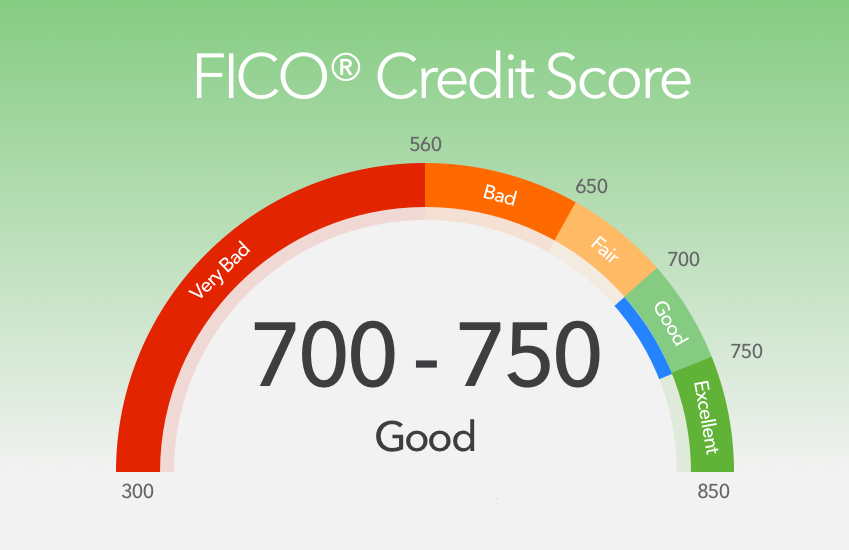

FICO scores are dynamic and can change up or down, if and when your data at the credit bureaus changes. The data is calculated in real time so they’re current as of the time you or a lender request them. FICO scores generally range from 300 to 850 the higher the score, the lower the risk for the lender. You control your FICO scores because it’s based on your credit habits as captured in your credit report. Your FICO scores do not determine whether you’re approved for credit or what interest rate is assigned, that’s up to the lender but it does help the lender make that credit granting decision.

So why do FICO scores matter to you? First it makes the lending process faster and fairer. It provides you with more credit choices at competitive rates, and you’ll get faster answers from lenders since the scores streamline the application process and the same set of standards applies to all borrowers.

Finally, as you prepare to apply for a loan and view your own FICO scores, you can see what a lender sees, your credit history all rolled up in a three digit number that predicts your likelihood to pay your bills on time.